Best Broker For Forex Trading for Beginners

Table of ContentsThe Buzz on Best Broker For Forex TradingMore About Best Broker For Forex TradingThe Buzz on Best Broker For Forex TradingBest Broker For Forex Trading Fundamentals ExplainedFascination About Best Broker For Forex Trading

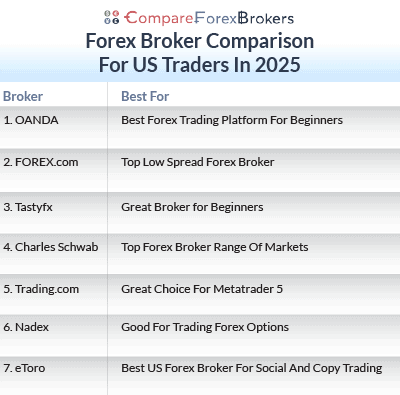

You ought to take into consideration whether you can afford to take the high danger of shedding your money. In summary, it is wished that you now have the called for knowledge to discover an online foreign exchange broker that satisfies your demands. Whether it is regulation, trading charges, down payments and withdrawals, consumer assistance, trading devices, or the spread you now know what to watch out for when picking a brand-new system.However, if you do not have the time to research study systems on your own, it may be worth discovering the top 5 recommended forex brokers that we have gone over over. Each forex broker masters a particular department, such as low fees, mobile trading, user-friendliness, or count on. Eventually, just see to it that you understand the risks of trading forex online.

This suggests that significant foreign exchange sets are topped to take advantage of levels of 30:1, and minors/exotics at 20:1. Nevertheless, if you are an expert trader, these limits can go right up to 500:1 on majors. While minimal deposits will differ from broker-to-broker, this typically standards 100 in the UK. If the broker is based in the UK, after that it needs to be controlled by the FCA.

With such a huge market, there will be always a person ready to purchase or sell any kind of money at the estimated rate, making it very easy to open and shut professions or transactions at any moment of the day. There are periods of high volatility throughout which it may be not easy to obtain a good fill.

The 9-Minute Rule for Best Broker For Forex Trading

However as any kind of other market, throughout durations of instability slippage is always a possibility. Greater liquidity also makes it difficult to manipulate the market in an extensive manner. If a few of its individuals attempt to manipulate it, the participants would certainly call for huge amounts of cash (10s of billions) making it practically impossible.

We will speak about this in the future. The Forex market is an around the clock market. Best Broker For Forex Trading. This suggests that you can open up or close any type of placement at any moment from Sunday 5:00 pm EST (Eastern Criterion Time) when New Zealand starts procedures to Friday 5:00 pm EST, when San Francisco ends procedures

Some brokers provide to 400:1 leverage, implying that you can manage for example a 100,000 US dollar deal with just.25% or US$ 250. This additionally permits us to keep our working capital at the minimum. However, beware as this is a double-edged sword. If the leverage is not effectively utilized, this could likewise be a downside.

We will go deeper in to this in the adhering to lesson Consequently, utilizing leverage higher than 50:1 is not advised. Remember: the margin is utilized as a deposit; whatever else is also in jeopardy. The Foreign exchange market is considered one of the marketplaces with the least expensive expenses of trading.

How Best Broker For Forex Trading can Save You Time, Stress, and Money.

There are 2 essential gamers you can't bypass in the foreign exchange (FX) market, the liquidity suppliers and brokers. While brokers link traders to liquidity companies and perform trades on behalf of the traders.

Brokers are people or business who represent traders to purchase and sell properties. Believe of them as middlemans, assisting in purchases between traders and LPs. Without them, investors would certainly experience problem with purchases and the smooth flow of trade. Every broker requires to obtain a permit. They are managed by financial regulatory bodies, there are over 100 regulative bodies globally, these bodies have differing levels of focus and authority.

The smart Trick of Best Broker For Forex Trading That Nobody is Talking About

After the celebrations agree, the broker forwards the LP's deal to the trader. As soon as the price and terms are satisfactory, the profession is executed, and the property is moved. To summarize the cooperative dance, each event websites take their share of the made cost. Online brokers bill the investor a compensation while LPs gain earnings when they get or sell possessions at profitable costs.

Electronic Interaction Networks (ECNs) attach investors to countless LPs, they offer affordable prices and clear implementation. Here the broker itself acts as the LP, in this model, the broker takes the opposite side of the profession.

When both parties get on the very same web page, the relationship between both is normally valuable. A collaboration with LPs makes it simpler for brokers to satisfy different trade proposals, generating more clients and boosting their business. When on-line brokers access multiple LPs, they can provide competitive prices to investors which boosts boosted customer contentment and commitment.

Top Guidelines Of Best Broker For Forex Trading

Let's study the crucial Click Here areas where this cooperation beams. This partnership assists to expand the broker's funding base and enables them to offer bigger profession sizes and cater to institutional customers with significant investment demands. It likewise widens LPs' reach through confirmed broker networks, thus providing the LPs access to a bigger puddle of prospective customers.